If you’re wondering what makes Online Optimism a top New Orleans digital marketing firm, it’s because:

You Own all the Creative Content

When working with Online Optimism, you own all the media and content we create for you from day 1. We aren’t picky about how our media files are utilized, so if you want to use our creations on billboards or YouTube, you have the power to do so. We want you to get as much value out of our work as possible, so anything we create for you belongs to you.

We Offer Marketing and Web Development All in One

While our New Orleans digital marketing efforts aim to bring you increased traffic and business, we also ensure that your audience is directed to a user-friendly website. From design to content, our team can help you handle website development to create the most impressive site possible. And because our departments collaborate to help you achieve a well-rounded online presence, you can rest assured that everything from your logo to your about page will project your cohesive brand identity.

We’re an Optimistic Agency

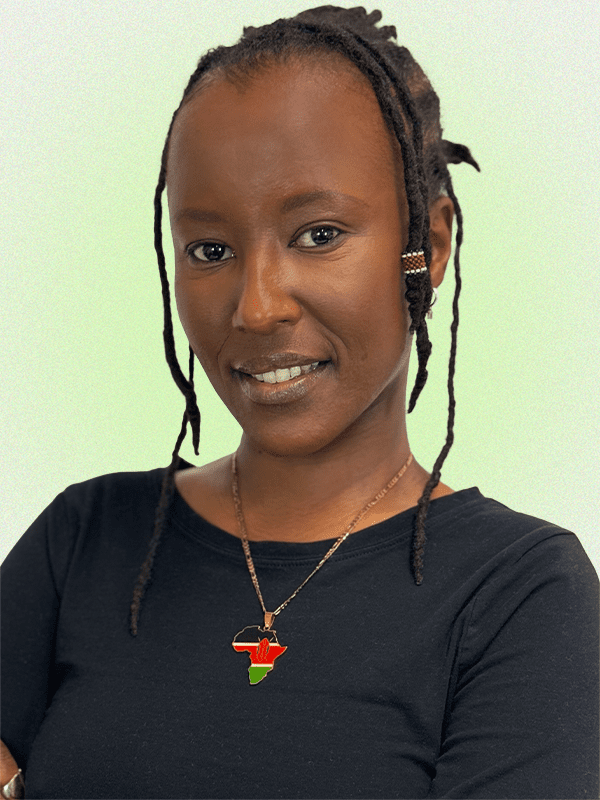

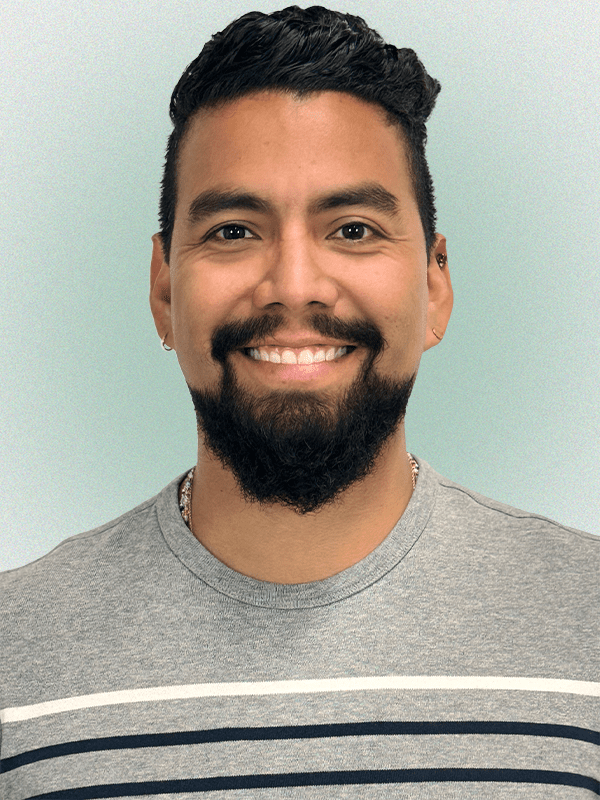

At our New Orleans digital marketing agency, there is no middleman: you will always speak directly with our team, and the Account Executive will always be someone in one of our departments who knows the ins and outs of your campaign. We are always available to answer your questions, troubleshoot your campaign, and be exceptionally helpful in any way we can.

Being an OO Client

Once our team receives verbal confirmation that you want to work with us, we can begin the onboarding process. The process typically takes three weeks, so our Optimists can get up to speed and familiarize themselves with every aspect of your brand.

We start with a kickoff meeting that gives our team the chance to ask you and your team various questions about your business, including its voice, goals, metrics for success, target audience, personas, and everything else we need to know to craft a campaign tailored to your needs.

Our New Orleans digital marketing team will create engagement guides, initial posts, targeted keyword lists, blog posts, and more for your approval following the kickoff, giving you a taste of the high-quality work you can expect month after month. When looking for a New Orleans digital marketing agency, it’s essential to select an agency that will track your progress to deliver concrete results. Here at Online Optimism, we’ll work to make sure all tracking codes are in place and are accurately measuring results correctly before your campaign begins.